Now that Amazon’s Prime Day 2021 has come to an end, let’s take a look at the key takeaways from this year’s event and review strategies brands can implement for future events on Amazon.

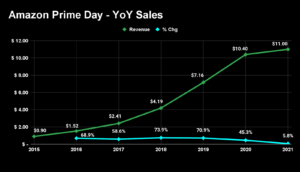

This year, Prime members purchased over 250 million items in categories such as electronics, home, fashion, and more. According to Adobe Analytics Data, online sales were 6.1% higher than last year’s event with over $11 billion in revenue generated.

Prime Day During the Height of the Pandemic

First, let’s review Prime Day 2020.

Last year’s Prime Day was shifted from June to October due to the Covid-19 pandemic. This announcement came at the last-minute to sellers, which meant many sellers quickly scrambled to submit any Prime Day promotions. Despite the last-minute announcement, Prime Day 2020 went extremely well. Amazon saw record-breaking sales due to the overall increase in online shopping caused by quarantine, in addition to Prime Day 2020’s proximity to the holiday season. Overall, Prime Day 2020 generated $10.4 billion in sales on Amazon, up from $7.2 billion the previous year.

While Prime Day Sales increased from 2020, year-over-year growth dropped significantly, only increasing by an estimated 5.8%.

Summary of Key Takeaways From Prime Day 2021

- Walmart, Target, and other big-box retailers are catching on to Prime Day’s success after last year and began running their own steep discounts online which coincided with Prime Day dates this year.

- Supply chain issues possibly limited 2021 Prime Day success.

- Consumers spent differently in 2021 compared to 2020.

- Early data shows that this year’s sales growth was modest compared to last.

Online Competitors took Advantage of Prime Day Traffic

This year many online retailers took advantage of the online shopping spike caused by Amazon’s Prime Day. Last Prime Day, retailers such as Target and Walmart started to offer their own deals, which led them to go full force this year. Both large and small online retailers launched deals at the same time as 2021 Prime Day (Monday, June 21st, and Tuesday, June 22nd).

Many online retailers had differences in their deals to set them apart from the rest. Some retailers even had deals that began earlier and ended later than Amazon’s Prime Day event. Another key difference between most of these competitor deals and Prime Day is that they often didn’t require a premium subscription, whereas Prime Day deals were only available to shoppers with Prime memberships.

Supply Chain Issues Might Have Hurt Prime Day Success

Some experts have claimed that Prime Day’s success this year could have been hindered by supply chain issues from the ongoing effects of the Covid-19 pandemic. These widespread supply chain disruptions included:

- Limited warehouse space for inventory

- Labor shortages

- Higher shipping costs were largely due to a spike in Covid cases in Southern China and led to huge disruptions at major Chinese ports.

- Stock shortages of key parts (such as chips for electronics)

Additionally, last Prime Day, sellers and vendors benefited from their inventory levels at the time. At the beginning of October, sellers and vendors were already ramping up inventory for the Q4 holiday season. This Prime Day, without the increased inventory for the holidays and the supply chain issues mentioned above, seller and vendor sales growth suffered.

Shoppers are Spending Differently Per Order This Year

This Prime Day, experts say that shoppers spent less per order on Amazon. According to Numerator, U.S. consumers spent less per order during the first 32 hours of Prime Day 2021 than in the two previous Prime Day events. This indicates that consumers were most likely looking to buy less expensive everyday household items instead of spending on big-ticket electronics.

The shift from big-ticket items like electronics could be due to multiple reasons. Other big-box retailers like Best Buy or Target are taking some of these sales away from Amazon since they are launching their own deals. The shift from categories may also be a true shift in consumer spending due to the lasting effects of the pandemic. More shoppers are looking for their everyday household items online than they did in the past.

Overall, top categories during Prime Day shifted due to this change in spending habits. According to Numerator last year, electronics was the top category, while this year, household essentials and apparel were leaders. Trends in search volume data suggest continued increases in these categories on Amazon, indicating that these categories will continue to be key growth drivers for the eCommerce giant.

Lastly, Amazon and Walmart both competed to boost their fashion category this Prime Day. Amazon recently took Walmart’s place as the top apparel seller in the US. Additionally, Amazon started fashion promotions weeks before Prime Day. This year, Amazon had “The Prime Day Big Style Sale,” which gave discounts on Amazon-specific apparel and other brand’s active and loungewear. Walmart had their own deals at the same time during their Deals for Days event.

Early Data Shows That Prime Day’s Sales were Modest Compared to Last

According to early data, Prime Day 2021 sales did not grow as rapidly as in Prime Day 2021. This can be attributed to 2020 Prime Day taking place right before the shopping holiday season or the supply chain issues mentioned above. Many sellers have seen lower YoY sales growth this year in comparison to 2019 to 2020 sales growth.

Looking Forward: Strategies to Implement Next Year or Before the Holidays

Although this Prime Day has passed, we can still learn how to improve for the next Prime Day or future tentpole shopping periods such as the Q4 holiday! Here are a few helpful tips to implement in your strategy:

1. Increase BSR (Amazon’s Best Seller Rank) by running small promos a few weeks before peak traffic times.

Sales ranking is extremely dependent on recent sales velocity, so by running smaller promotions (coupons) leading into key sales peaks, you can work towards increasing rank for your top listings. Increasing rank and organic traffic for your listings will drive more visibility on Amazon during high-traffic periods (like Prime Day and the holidays). Read more about how Amazon’s A10 Algorithm ranks products here.

2. Drive as much traffic OFF Amazon as possible during peak timeframes.

During peak shopping periods, it is crucial to not solely rely on Amazon advertising to drive traffic to your listings.

You can drive traffic to your Amazon listing through DSP or social media campaigns. For example, you can add Amazon promotional links to Facebook or Instagram campaigns. This will bring consumers directly to your listings, which will help your overall BSR and increase conversions. Learn more about why Direct Agents recommends driving traffic from external marketing channels here.

3. Increase daily budgets and bids leading up to and during Prime Day.

Before and during Prime Day or peak holiday shopping days like Cyber Weekend, increasing Amazon advertising budgets and bids to allow campaigns to keep on spending is important. Advertisers must be aggressive during these high-traffic periods. Make sure to closely monitor campaigns on these days to make sure you don’t miss out on the increase in traffic due to over pacing budgets.

4. Run deals when possible for visibility on Amazon during peak sale periods.

If possible, run both Amazon deals and coupons during Prime Day or the holiday season. Deals help seller listings appear in more places such as deal-specific pages.

For Prime Day specifically, consumers are more likely going to view and convert on your listings when there is a “Prime Day Deal” badge next to the price of your product. “Prime Deal” badges drive better performance than regular coupons and promotions. On Prime Day, consumers try to take advantage of these limited-time deals and are more likely to purchase. If sellers missed the deadline to submit Prime Day deals, they saw a lower performance with regular promotion CTA’s (call-to-action).

Direct Agents has a team of eCommerce experts who help our clients grow their business on Amazon. We specialize in optimizing product pages based on each marketplace’s algorithm and defined inputs while staying true to the brand’s voice. If you are looking for help getting your business started on Amazon, reach out below.

Look out for more helpful Amazon insights and strategies in future blog posts to learn how Direct Agents can help your business grow on Amazon.

– Sara Rosenberg, eCommerce Strategist