Retail Media has emerged as the fastest-growing segment in Digital, with Walmart and Target being the leading drivers of growth (outside of Amazon). These two retail giants have historically dominated the offline market, accounting for over $500 billion in U.S. Retail Sales in 2021, but now offer advertisers significant growth potential through their online advertising solutions.

Although both platforms are already household names, they are unique in what they can provide your business. Through Direct Agents’ extensive experience, we have found that both marketplaces can help brands increase visibility, reach, and sales growth if we first understand the similarities and differences of the target buyers within those marketplaces.

First, Walmart. For the vast majority of our clients, Walmart has shown to have lower CPCs, more forms of ad placements like Sponsored Brands and Sponsored Display, and a mature self-service platform for sellers to take advantage of. Target Ads, on the other hand, can only be run through their media arm Roundel or through select providers that tap into their sponsored placement inventory.

When we compare the performance between the two, Target has shown higher ROI across a wider range of product categories and prices when compared to Walmart, which we attribute to the nature of the buyer.

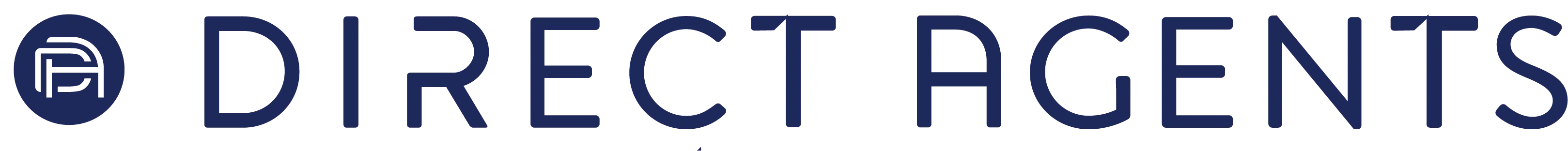

Due to the nature of the price-conscious Walmart buyer, inelastic product categories have seen more success on their online platform, according to a survey conducted by Jungle Scout, around 53% of shoppers on Walmart.com purchased Groceries while less than 25% of shoppers purchased from the Toys, Arts Supplies, and Alcohol product categories.

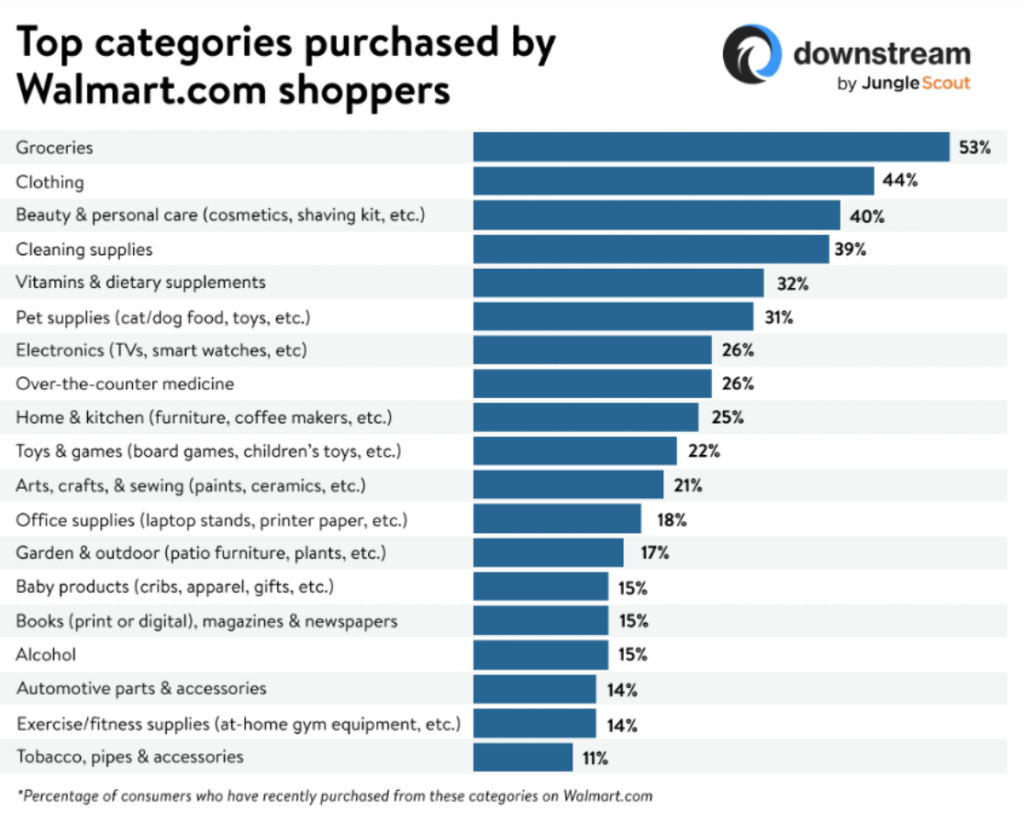

Although we have seen on average lower ROI on Walmart.com compared to Target.com, the overall impact of online placements on in-store traffic and conversions should also be considered. According to a 2023 Retail Trends Forecast, in 2022 Walmart had just under 155% more in-store traffic than it did online traffic, and Target only had 33% more in-store traffic than online. With Walmart having more than double the number of physical stores in the U.S. than Target, the lower online conversion rate can be partially attributed to consumers preferring to make their final purchases in-store.

While we’ve outlined a few key differences in consumer behavior between the two retailers, there are a few similarities as well. Both Target and Walmart do not allow competitor conquesting, meaning branded placements will be more easily protected at a lower CPC when compared to that of Amazon. In addition, both allow advertisers to quantify offline conversions made from online advertisements. For Target, third-party applications allow you to isolate in-store conversions in their analytics report, while Walmart’s advertising platform provides offline attributed sales when running Display campaigns.

Overall, advertisers should be aware of a few things when planning for marketplaces:

- To optimize your product mix for Walmart and Target, begin by selecting your top-selling products from your direct-to-consumer or Amazon channels.

- Experiment with lower-priced SKUs on Walmart, as their consumers are more budget-conscious.

- Make sure to adjust your product roadmap to align with each retailer’s unique consumer behaviors and ideal price points.

- To create media plans for different marketplaces, take into account your product category and identify which categories perform best for each retailer.

- E.g. Beauty products are a significant revenue generator for Target, whereas Walmart’s primary sales come from Grocery products.

While Amazon continues to be a leader in the e-commerce world, it is still crucial to be proactive in expanding to other marketplaces to grow your business. Walmart and Target are the two most significant players and deserve your attention and marketing budgets. If you want to learn more about Direct Agents’ Retail Media offerings and how our eCommerce team can help your brand grow on Target or Walmart, please contact [email protected].

Augustine Ahn, eCommerce Analyst, Direct Agents

References

Statista: Number of Target stores in the United States from 2006 to 2021

Statista: Number of Walmart U.S. stores in the United States from fiscal year 2012 to 2022, by type

Statista: Sales of Target in the United States from 2017 to 2021, by product segment