Black Friday and Cyber Monday have officially come to a close this year. As many may have predicted, 2021 BF and CM have shown some unique trends due to supply shortages and holiday deals starting sooner this year.

When comparing year-over-year trends for our clients based in the gifting categories including toys/games and technology verticals, we uncovered interesting organic and paid trends unique to 2021.

Below we break down the trends seen in overall retail and paid media as well as what we can expect for the remainder of this holiday shopping season.

Retail Trends:

Black Friday as a single day didn’t drive as many sales as expected for many brands, but November as a whole drove large online sales lifts YoY.

While Black Friday didn’t drive as large of an increase on its own, when comparing 2020 to 2021 and looking at the entire week of Black Friday, we found that our clients had a 15 – 59% increase in sales year over year.

Sales often began to increase on Black Friday but actually remained just as strong throughout the weekend and in many cases, peaked on Cyber Monday.

Traffic did not increase as much during the week of Black Friday 2021.

Interestingly, glance views were down YoY throughout November and the week of Black Friday for the majority of our clients. This is an indicator of lower traffic on Amazon in 2021 due to most consumers starting their holiday shopping as early as September to avoid any supply chain hiccups.

For our one client that experienced increased BF/CM traffic this year, we found that running promotions earlier throughout the month leading up to Black Friday as well as having strong brand awareness going into Q4 helped with an increase in overall glance views, ordered revenue, and units ordered as their overall category ranking increased.

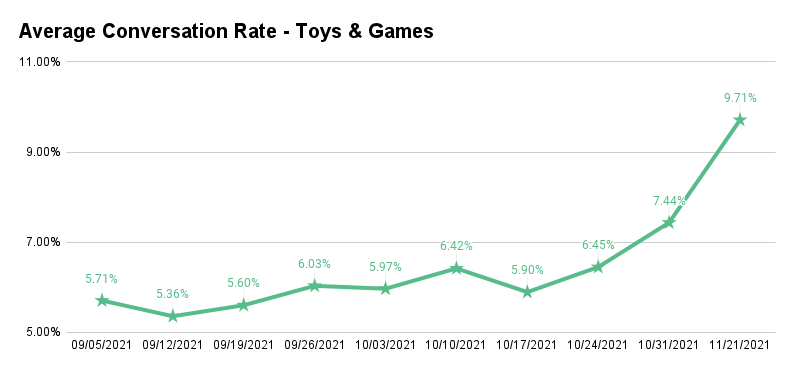

Consumers took advantage of discounts before Black Friday and Cyber Monday, driving an earlier increase in Q4 conversions than in past years.

This year more than ever, we have seen deals and steep promotions running as early as October to drive holiday sales. Our brands’ October conversion rates increase an average of 5 -14% YoY.

The chart below illustrates a clear week-over-week, the upward trend in conversion beginning near the end of October and continually increasing all the way up to Black Friday.

Amazon Advertising Trends:

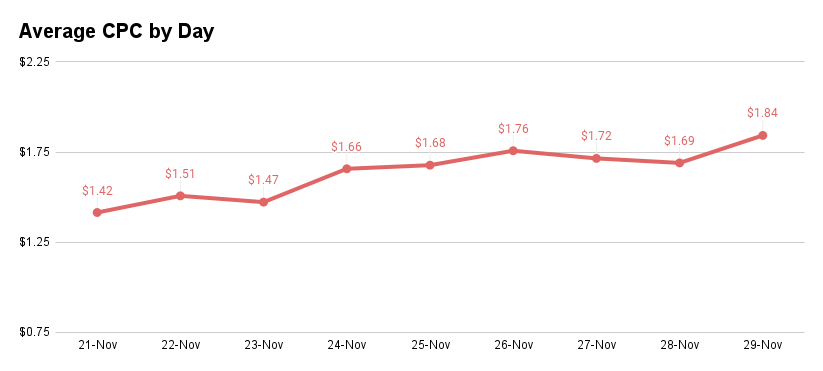

Cyber Monday proved to be the more advantageous day for holiday sales this year and ad costs reflected this.

Across all of our Amazon clients that offer giftable products, 75% of our accounts spent more on Cyber Monday than on Black Friday. CPCs were the highest on Cyber Monday compared to any other day in the week leading up to it.

We use CPC, or cost-per-click, as a way of gauging how much competition there was on a particular day and how much this competition is going to cost us. November’s average CPCs increased in 2021 vs 2020, by a difference ranging from 7 – 14%.

The below graph shows day by day CPC for our clients leading up to Cyber Monday where we see a considerable increase:

While ads help grow a brand’s visibility and sales during Black Friday and Cyber Monday, consumers engage differently on Amazon’s platform during this time than on other days throughout the year.

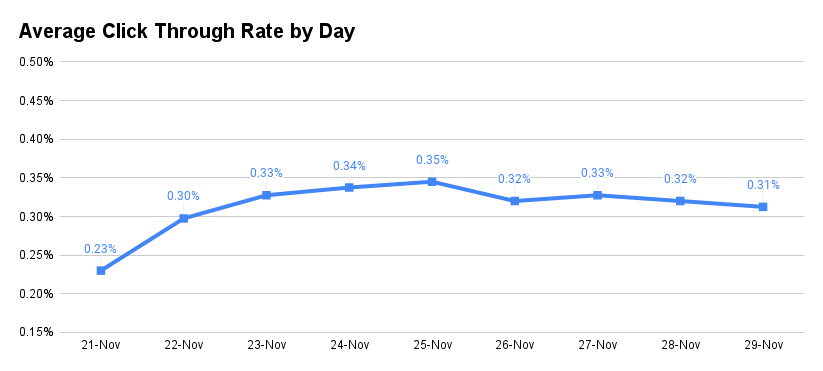

Interestingly for our clients in the “Toys & Games” categories, click-through rates (CTRs) were lower than average on both Cyber Monday and Black Friday.

We believe this is due to consumers shopping directly through Amazon’s Deals Pages versus their normal search bar shopping behavior. They may also be more swayed into clicking on a product lower in the search results if it displays a deal badge, which can also help drive conversions and lead to less engagement with ads.

Below you’ll see that the average CTR % by day began to decline on Black Friday (Nov. 26th).

Deals drove better results than coupons.

While consumers want to find the best deals possible during this time, they go directly to Amazon’s deal pages. For one client, sales almost doubled on Cyber Monday instead of on Black Friday because they ran deals that Monday.

Overall, they achieved a +250% sales lift on Cyber Monday while our other clients who only drove a +150% increase when using coupons.

Final Thoughts

In conclusion, while Black Friday and Cyber Monday may not have seen as large day-over-day increases as some expected, we saw much larger peaks when looking at November as a whole versus last year.

No doubt consumers have been shopping earlier and catching any deal they can throughout their shopping journey this year. However, there is still plenty of shopping to be done.

December may look a little different than last year and it will be interesting to see who runs out of supply early on. Pay attention to your competitors’ inventory levels across digital spaces for the next month and be ready to capture their lost sales since consumers will be converting quickly before shipping cutoffs.

If possible, try to run a deal on any items you have healthy supply levels of in December to drive additional sales and traffic.

Looking ahead to 2022, we predict another early shopping season, regardless of supply chain shortages. Keep a close eye on 2021 holiday trends as this may very well be the new normal.

Happy shopping!

Bridget Menne, eCommerce Client Success Coordinator

Emily Lease, Associate Director of eCommerce